During the next 12 days, I will learn and repeat the basics

of structural equation modeling (SEM) using lavaan and semPlot packages in R.

You can search my lavaan posts by typing:

#UsmanZafarParacha_lavaan , and semPlot posts by typing:

#UsmanZafarParacha_semPlot

=============

During this day, I learned and studied about Confirmatory

Factor Analysis (CFA) while implementing a polychoric matrix and use the robust

diagonally weighted least squares (RDWLS) method to evaluate the model fit

using several fit indices such as RMSEA, CFI, TLI, SRMR, and chi-square/DF.

This same thing can also be found in one of the research papers, such as that

conducted Almeida et al. (2024).

Initially, I loaded the essential libraries and created

supposed data using the following lines of codes:

library(lavaan)

library(semPlot)

library(psych)

set.seed(123) # For

reproducibility

n <- 200 # Number

of participants

# Simulate ordinal data (Likert scale: 1 to 5)

item1 <- sample(1:5, n, replace = TRUE)

item2 <- sample(1:5, n, replace = TRUE)

item3 <- sample(1:5, n, replace = TRUE)

item4 <- sample(1:5, n, replace = TRUE)

item5 <- sample(1:5, n, replace = TRUE)

# Create a data frame

data <- data.frame(item1, item2, item3, item4, item5)

Then, using the psych package, the polychoric correlation

matrix was determined:

polychoric_matrix <- polychoric(data)$rho

The CFA model was specified:

cfa_model <- '

Factor1 =~ item1 +

item2 + item3

Factor2 =~ item4 +

item5

'

fit <- cfa(cfa_model, sample.cov = polychoric_matrix,

sample.nobs = n, estimator = "ML")

and the model fit was checked:

summary(fit, fit.measures = TRUE, standardized = TRUE)

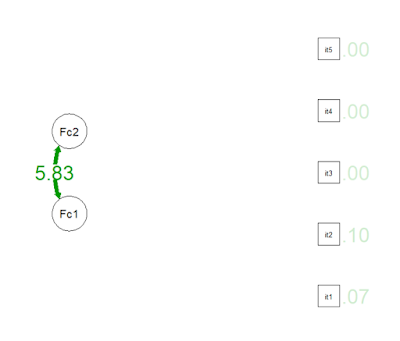

Eventually, the CFA model was visualized:

semPaths(fit, what = "std", edge.label.cex = 1.2,

layout = "tree", style = "lisrel", rotation = 2)

Sources:

Almeida, D. M.,

Santos-de-Araújo, A. D., Júnior, J. M. C. B., Cacere, M., Pontes-Silva, A.,

Costa, C. P., ... & Bassi-Dibai, D. (2024). The best internal structure of

the Diabetes Quality of Life Measure (DQOL) in Brazilian patients. BMC

Public Health, 24(1), 580.

ChatGPT

.jpg)